2016 Real Estate trends predict three home selling insights for Park Cities, Preston Hollow, East Dallas and 75209.

Analyzing the market, spotting trends and applying insights directly to selling homes quickly and profitably for our clients is something we try to do on a daily basis.. These days, the question I hear most is “What is happening in this crazy market?” The fact is, there’s a lot at play, but these three areas are proving key.

1. Thinking about remodeling? Do it! But learn before you demo.

The price difference between a strategically updated house and one that needs renovation is dramatic. Needs work? Buyers expect big discounts. Updated? People are willing to pay exponentially extra…IF they love it.

Style Matters

So, go ahead. “Update.” And do it now so you can enjoy it now—even if you sell years later! Update is in quotes because this word no longer means granite counters and stainless steel appliances. In about 2011, buyers made a drastic change in desired style to “light, bright, and transitional” homes – a far cry from the stained-wood, Old World style that was popular for so long. Newer homes, built circa 2000-2010, are being regarded by buyers as “redos” despite only being a few years old. Not wanting to suffer through remodels themselves, we see buyers snapping up the few homes available with this transitional style at record prices. (A great example of this: I walked a buyer through a house just the other day and heard them proclaim it needed $50,000 worth of new countertops. Really? I was able to calculate those counters at just under $15,000 with the help of a contractor. This is just one reason why it pays to update!)

Be strategic about your updates.

Don’t remodel everything. Pick and choose what will get you returns. This includes exchanging granite counters for white marble or quartz, renovating the master bath, and almost without exception painting wood-stained cabinets.

Need help figuring out what updates your home needs and how to do it? We’re happy to provide guidance and suggest resources whether you are ready to sell your home now or later. Schedule a walk through.

2. So what’s real? And whose numbers can you trust?

There is big buzz about the enduring boom of real estate prices in the Dallas–Fort Worth area. Factors like a good economy, large companies moving to DFW, and the (now waning) oil boom in Fort Worth made our real estate market strong. But how have the neighborhoods “closer in” been performing versus the rest of the metroplex?

To answer accurately, it’s vital to compare like product with like product and understand what’s driving these upward trends.

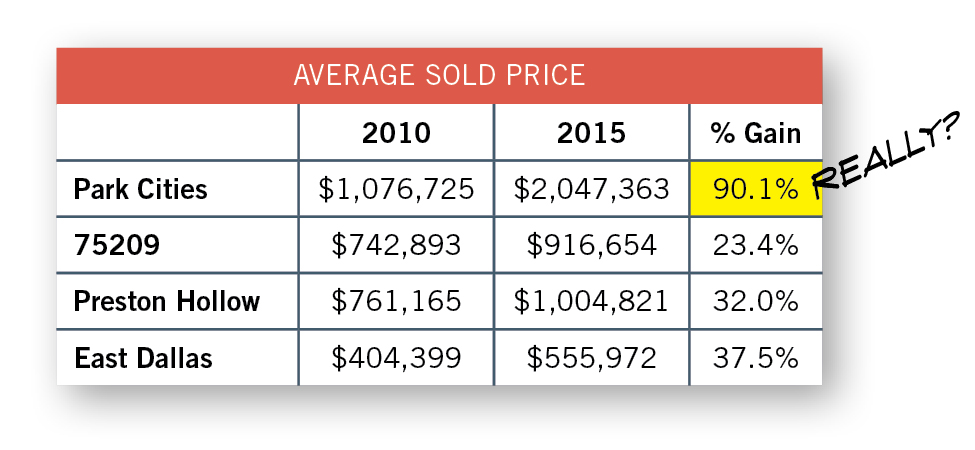

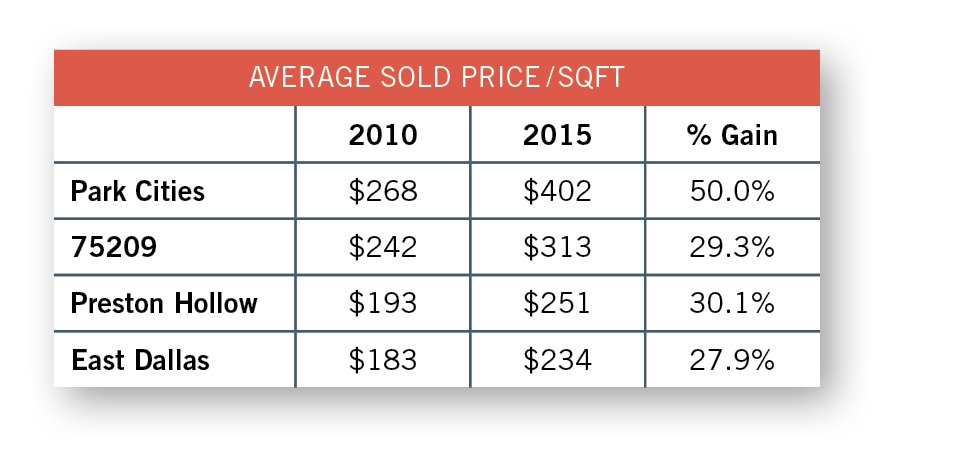

Published numbers for Average Sold Price can be misleading.

Media-reported Average Sold Price stats typically show wild gains (as shown above). Who wouldn’t like a whopping 90% price increase!? In our opinion, the Average Sold Price / Sqft. is a better indicator of market performance but still should be viewed with caution (since houses continue to be torn down and/or renovated). According to this statistic, almost all the established neighborhoods have seen a 5% appreciation year-over-year. Still very impressive—but these statistics rarely reflect a direct percentage gain for existing homes in your specific neighborhood.

So what are these gains really indicating? In a word: builders.

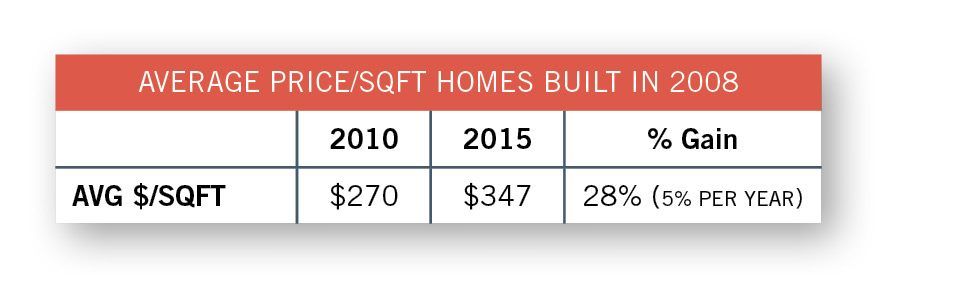

It’s no secret the demand for lots over the past five years in our established neighborhoods has been extraordinary. As new homes replace old ones at a multiple of 2-3 times in value, the Average Sold Price increases exponentially. Taking a small house, tearing it down and replacing it with a much bigger and thoroughly updated house is being translated into a sizeable gain in Average Sold Price —clearly a misleading statistic. So how do you calculate accurate gains for a neighborhood? The only way is to compare apples-to-apples. Take for example, University Park homes built in 2008…. This shows about a 28% gain in 5 years for similar homes. That’s roughly 5% per year – much closer to what we are seeing in the area.

This shows about a 28% gain in 5 years for similar homes. That’s roughly 5% per year – much closer to what we are seeing in the area.

What the Average Sold Price really means is it’s getting harder and harder for people to gain entry into these neighborhoods—not that your home price has doubled (sorry!)

How much is your house is actually worth?

The only way to get an accurate expected price per square foot for your home is to have an experienced Realtor do it. We are also happy to meet with our clients to give a customized market analysis for their home. Reach out and let us start calculating.

3. Are prices softening? Or still upward bound?

This is by far our most frequent question. Truth is, it depends on both your neighborhood and price range. We’ve seen buyer fury soften a bit in the Park Cities and Preston Hollow—but primarily in upper price ranges. (Don’t worry it’s still a good market to sell in, it just requires positioning savvy and guidance.) In addition, we’ve seen lot prices pull back from their highs of 2015. The most interesting trend is the return of the ultra-high-end spec. You may recall D Magazine’s article The $15 Million Spec Home in 2008 (http://www.dmagazine.com/publications/d-magazine/2008/july/the-15-millionspec-home). This article coincided with the beginning of the 2-year trough we had in real estate prices. Well, the big spec homes are back. There are two properties on Beverly being offered close to $8M, two on Lorraine around $6M, and several others just shy of that—all but one unsold. Combine this with low oil prices, a volatile stock market, and increasing inventory, signs indicate a possible slow down is on the horizon.

Where are the hot neighborhoods now?

There are still some bright spots in this market. There is a downright frenzy for mid to lower price points in the M-streets, Lakewood, the Park Cities, and pockets of 75209 (think Devonshire, Briarwood, Greenway Parks/Crest). Combine this price range with “good updates,” and you will see a home sell in a matter of hours. It often takes an agent in the know to get their buyers in front of these homes before they hit the market. We feel this “Coming Soon” trend will continue for the foreseeable future. A tight Realtor network like ours is often the key to getting access to the best homes. Let us list or look for you.

The takeaway for selling in 2016?

- Updating now in the new style is definitely worth it. The best thing you can do is make renovations where they make sense, enjoy them now and capitalize on the premium being offered for such improvements when you sell.

- Don’t be misled—know the real numbers. Make sure to set your price for what the market will bear to sell quickly and maximize return. Consulting experts who can decipher the code in your specific market is key.

- It IS still a seller’s market. Some neighborhoods are at their prime. Others show softening at the high end, but prices are still at the top and money remains cheap. All good news for those thinking of a move.

How do these insights apply to selling your home or buying your next? Talk to us.

Burton Rhodes, The Rhodes Group

We know your neighborhood.